Surprise medical bills are an upsetting, yet all too familiar reality for many Americans. As surprise bills continue to dominate the headlines, HealthSparq set out to find just how common this issue really is. We partnered with Hanover Research, an independent research and analytics firm, to survey more than 1,000 Americans on their experiences with unexpected medical bills. The results were not too surprising.

Overall, more than half (53%) of all respondents have received a surprise medical bill in the past 12 months. This includes:

- Bills that were higher than expected (60%)

- Bills for services thought to be covered by insurance but weren’t (62%)

- Multiple bills from multiple providers when just one bill was expected (42%)

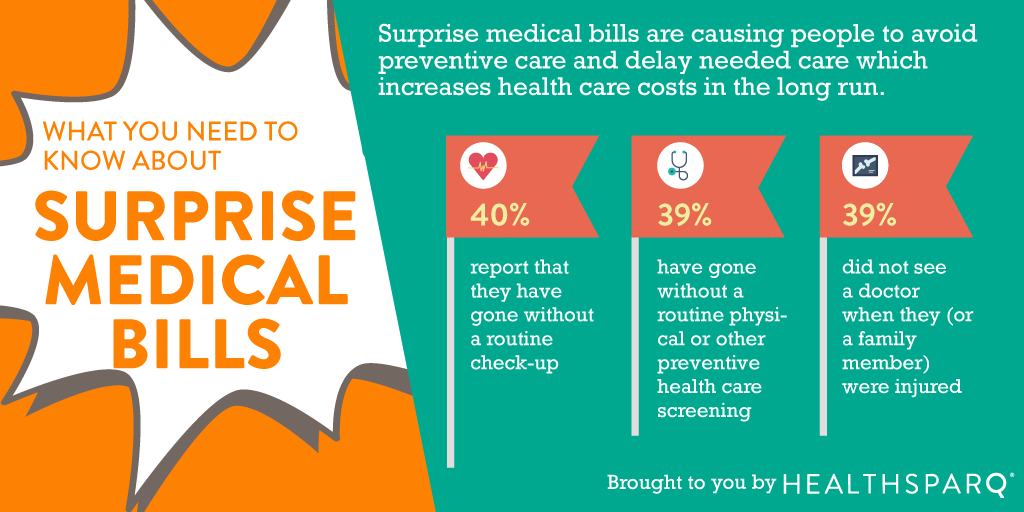

Unexpected medical bills can have a serious impact on a person’s financial wellbeing. But our survey found a consequence even more concerning – as a direct result of confusing or frustrating medical bills, people reported cutting back on health care costs to their own detriment. They often skip:

- Routine check-ups (40%)

- Routine physical or other preventative health care screening (39%)

- Care when they (or a family member) were injured (39%)

When preventive care and regular check-ups are missed the long-term costs are high. According to the CDC, chronic conditions such as heart disease, cancer and diabetes are responsible for 7 of every 10 deaths among Americans each year. When left untreated or undetected these conditions get worse and cost significantly more to treat in the long term, but they can be caught early and are even preventable through regular screenings and early interventions.

It is deeply troubling for many people when an unexpected bill is received, and consumers generally place the blame externally – either blaming insurance providers (45%) or their health providers (42%). Despite this natural reaction, consumers also recognize their own role in the frustration as 40% of those who received a surprise bill said they could have done more to better understand their benefits and health care processes.

So, how can consumers protect themselves when it comes to surprise medical bills?

With medical costs and insurance premiums rising, it’s more crucial than ever for people to engage in their care and ensure that their needs are being addressed. It begins with being proactive, offering honest information and advocating for yourself.

- Be proactive:

- One of the simplest ways to avoid surprise bills is by ensuring your doctor is in-network, meaning they have contracted with your insurance company to offer care at a lower rate. You should verify whether your doctor is in-network before your appointment. Just confirm with your doctor’s office or call your insurance carrier. If you’re receiving more complex treatment, like knee surgery for example, be sure to ask your doctor whether other people on your care team are also in-network. This simple step can help you avoid surprise costs.

- You can estimate the cost of your procedure or treatment and compare costs using the resources provided by your health plan or your doctor. Many health plans offer online tools that provide health care cost estimates and provider searches that are based on your benefits. Many of these resources also offer treatment information, facility and provider quality information, blog posts and live chats to help you make an informed decision.

- Offer honest information:

- Medical conversations can be stressful for many people. It is not uncommon for people to miss an important detail or not speak up during a conversation with their doctor. Bringing a family member or friend may help you feel more comfortable. You are more likely to share all of your symptoms, ask all of your questions and feel confident in sharing valuable information if you have a loved one by your side.

- Advocate for yourself:

- Any time you feel uncertain or uncomfortable with your prescribed treatment, seek out a second opinion. Feel empowered to speak up if you aren’t 100% comfortable with your doctor’s recommended care plan.

- Use the online resources at your disposal to research different options for care and/or treatments so you feel confident in navigating the health care system and raising concerns with your doctor.

Surprise billing is a systemic issue that affects everyone, including patients, providers, payers and more. There are a lot of issues to be reconciled before the topic is out of the headlines, but there are a few ways that people can best position themselves to be not only patients but informed healthcare consumers.